W9 Tax Form: Example and Explanation for U.S. Employees

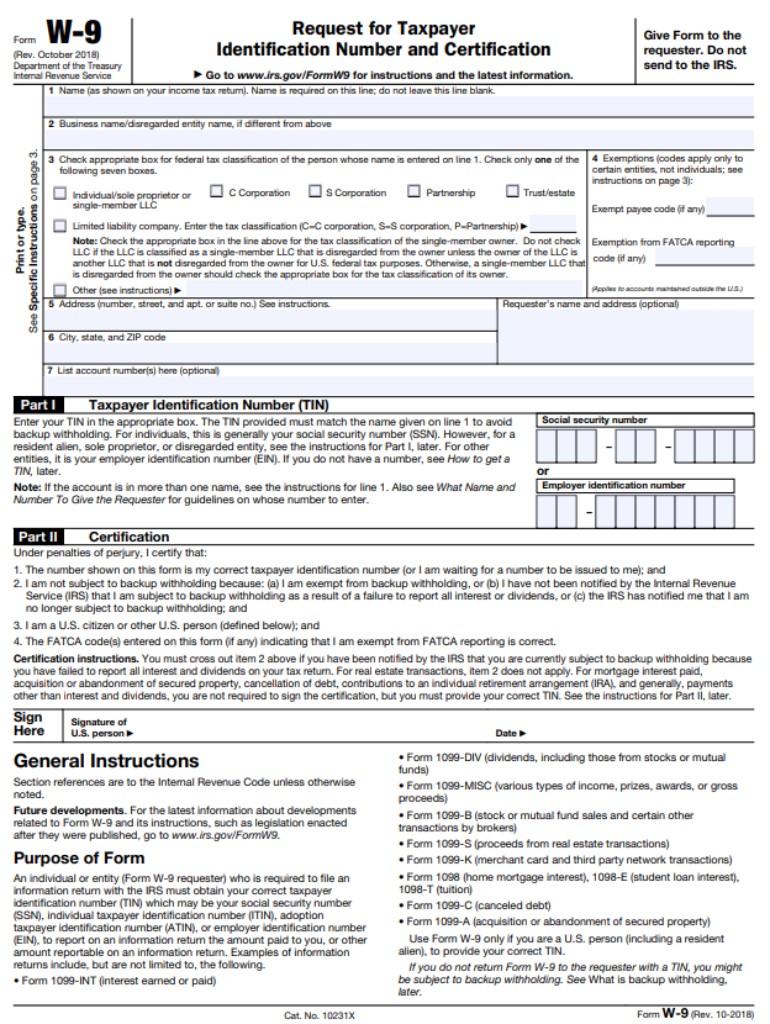

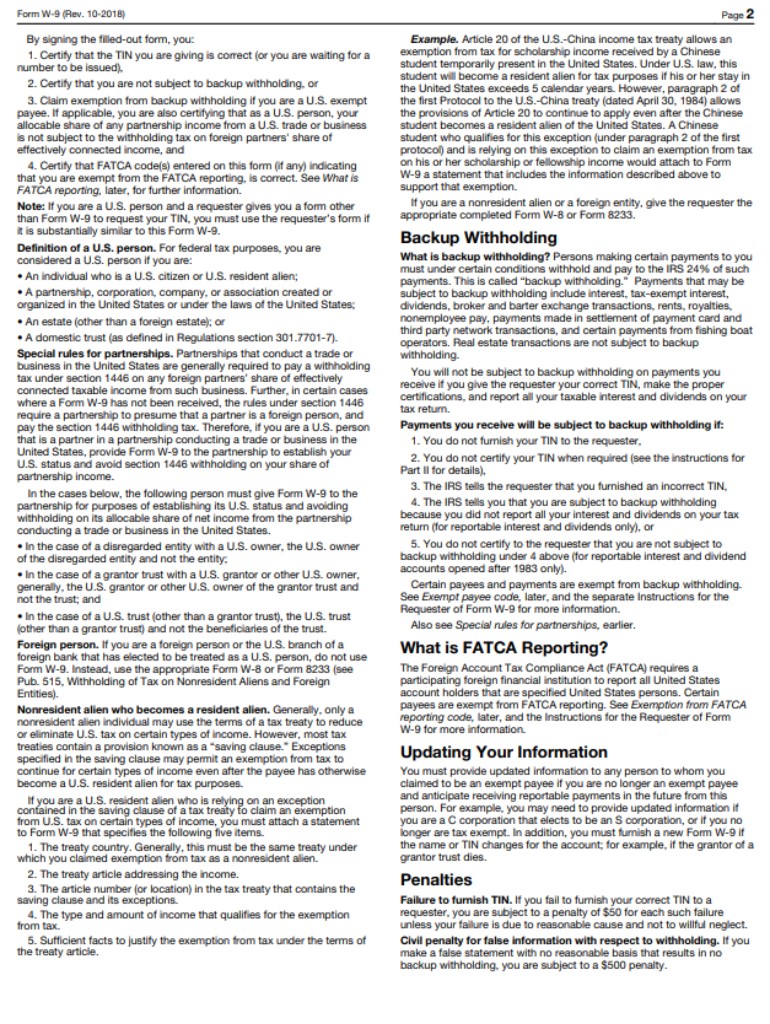

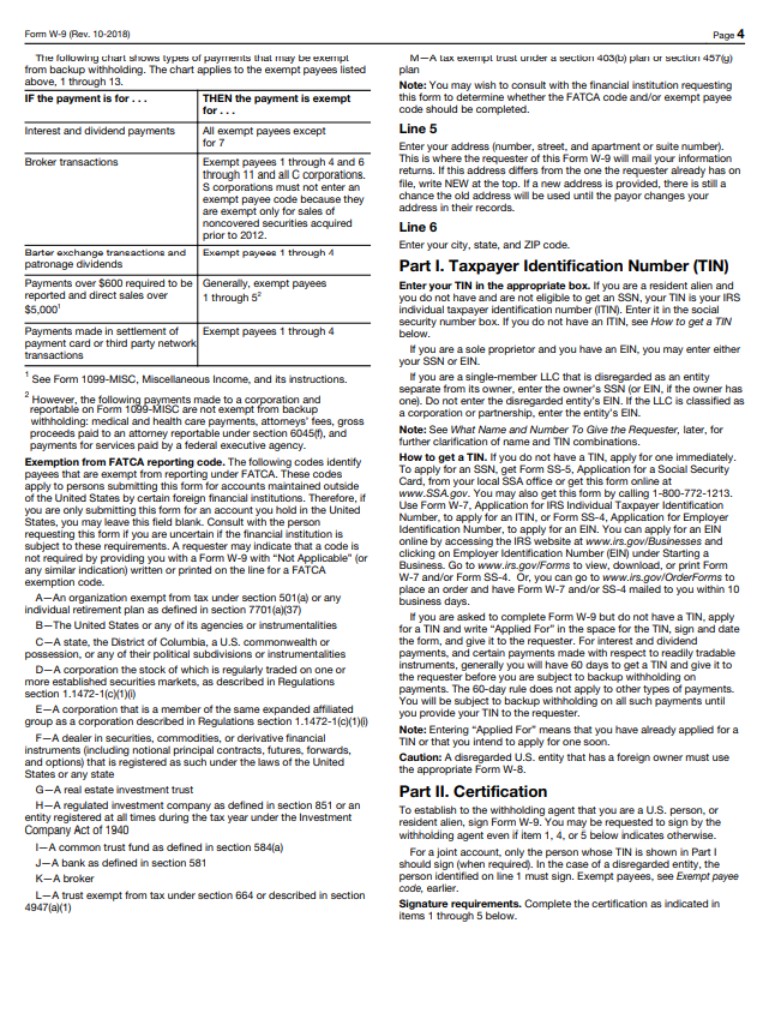

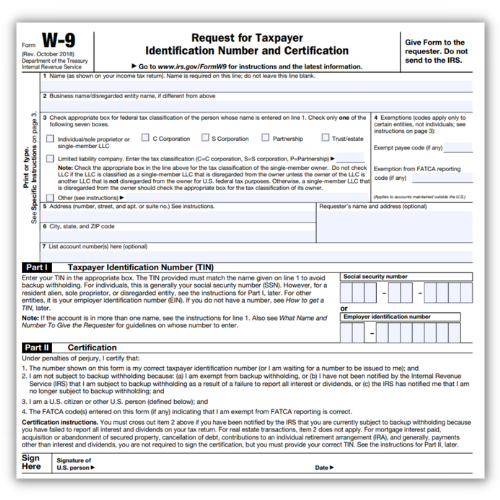

IRS Form W-9 is a document that provides a taxpayer identification number (TIN) and certifies that the TIN provided is correct. It's typically used by businesses and individuals who pay other businesses or individuals. The form is important because it's used to report the income earned by the recipient to the IRS and helps to ensure that the correct amount of taxes are paid. Failure to provide a correct TIN can result in penalties and fines.

Filing the IRS W-9 form for 2024 can be a daunting task for some taxpayers, but our website w9-form-printable.net provides clear instructions and sample forms to make the process as easy as possible. The website is updated with the latest information for the year 2024, making it a valuable resource for anyone looking to download W-9 tax form and file it correctly. By using our website, taxpayers can ensure they’re providing accurate information and avoid any potential penalties.

There are some forms related to the W-9:

Important Note

It's important to note that Form W-9 isn’t filed with the IRS by the individual or business receiving the payments, but rather it's provided to the payer of the income. The payer is then responsible for using the information on the Form W-9 to report the income to the IRS on the appropriate information return.

People Who Must File IRS Form W-9

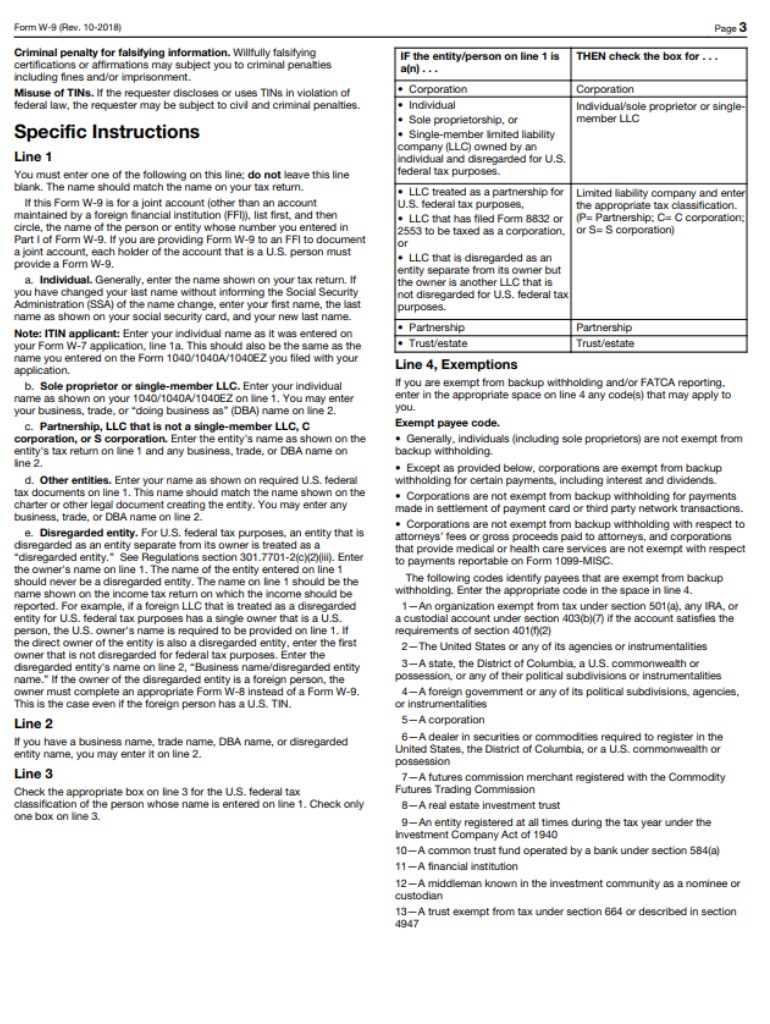

Form W9 is an essential document that provides a TIN (taxpayer identification number) to the IRS. It's typically required when a business or individual makes payments to others. If you're a US citizen or a resident alien who receives service payments, you must fill out a blank W-9 form printable and file it. This includes payments for freelance work, rental income, and other types of non-employment income.

However, there are some exceptions to this rule:

- If you're a corporation, you do not need to complete a Form W-9.

- Additionally, if you're a foreign person, you're not required to complete a Form W-9.

For example, John is a freelance graphic designer who receives payment for services from various clients. In this case, John would need to fill in and file a Form W-9 with the Internal Revenue Service, as he is receiving non-employment income. He can find IRS Form W-9 printable or fillable PDF from our website w9-form-printable.net which provide the current blank samples and instructions. He can fill out the form online, print it, and mail it to the IRS.

Advantages of Printable IRS W-9 Form & Online Version

In general, it's better to choose a printable blank W-9 form to file if you prefer to fill it out by hand or if you don't have access to a computer or internet connection. This option allows you to physically fill out free printable W9 tax form by writing in the required information using a pen or pencil. Once completed, you can mail the form to Internal Revenue Service or the payer.

On the other hand, a fillable PDF template might be handier if you prefer to fill out W-9 form online or if you need to make changes to the form frequently. This option allows you to complete the W9 form on a computer, tablet, or smartphone and save the form electronically. You can then either print it out or submit it electronically.

Additionally, for people not confident in their writing skills and who want to avoid mistakes, the W-9 fillable form for 2022 can be a better option as it has built-in validation, which can help to ensure that all required information is entered correctly and all fields are filled in. It can also be a good option for those with many forms to complete, as it allows for faster data entry and eliminates the need for manual data entry.

Due Date

Currently, the schedule for filing Form W-9 with the IRS hasn’t changed. The form is typically required to be filed on an as-needed basis, meaning that it should be completed and submitted whenever a company or individual makes payments to another company or individual. The payer should print W9 tax form and send it to the payee so he or she can submit it to the IRS along with the information returns such as 1099-MISC or 1099-NEC.

Popular Questions About Federal W-9 Form

The Latest News

Please Note

This website (w9-form-printable.net) is not an official representative, creator or developer of this application, game, or product. All the copyrighted materials belong to their respective owners. All the content on this website is used for educational and informative purposes only.