Form W-9 Download

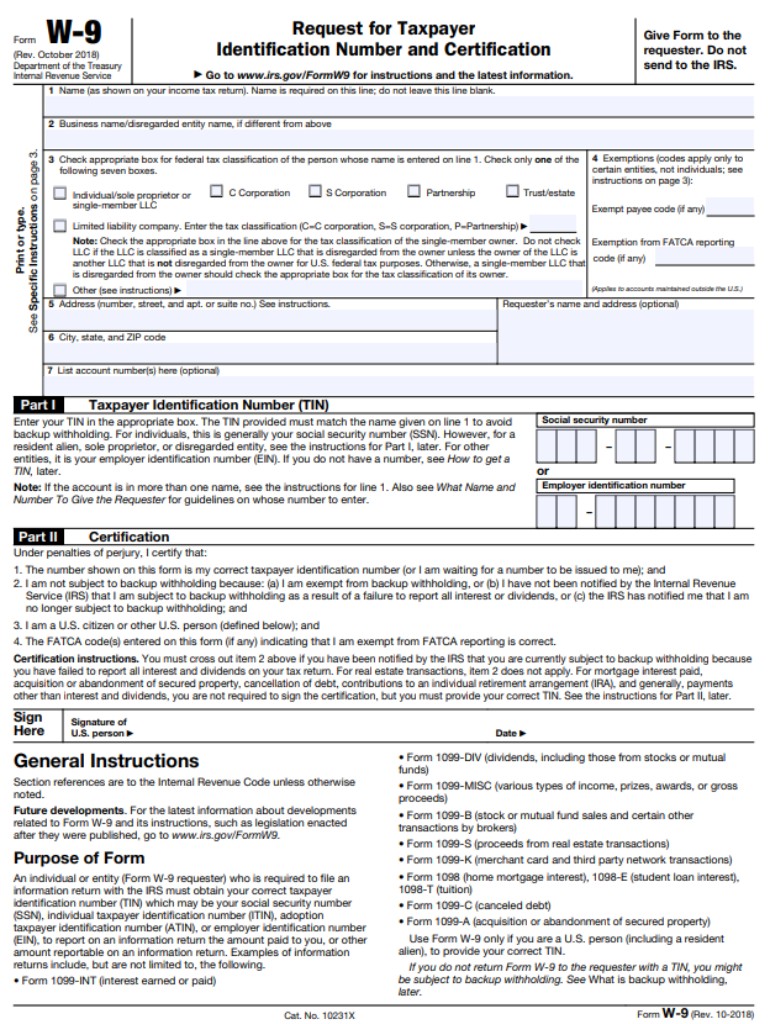

The W-9 form, also known as the Request for Taxpayer Identification Number and Certification, is an important form used in the business world. It is used to obtain the taxpayer identification number (TIN) and certification of an individual or entity, typically for tax reporting purposes. Businesses and organizations will often request a W-9 from vendors or independent contractors to ensure that they have accurate information for tax reporting. The form is important for the business and for the individuals or entities who are providing their TIN, as it helps in ensuring compliance with the tax laws and regulations.

Requested information

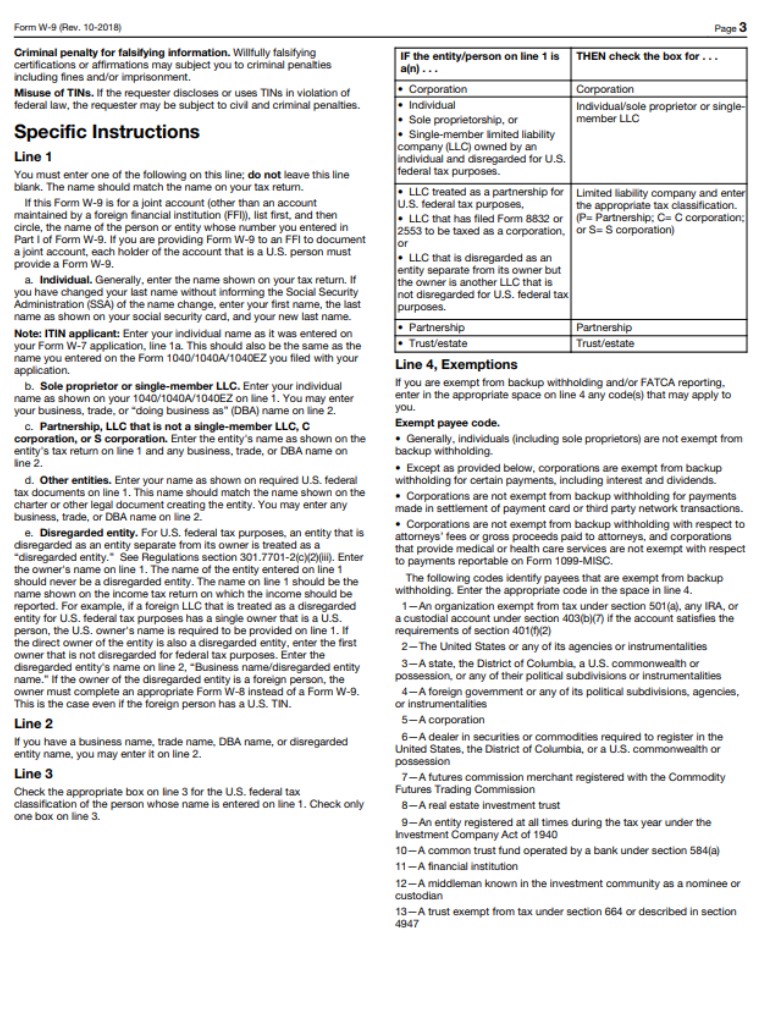

The W-9 form is a simple one-page form that requests certain information from the individual or entity providing their TIN. The information requested on the form includes:

- the legal name of the individual or entity,

- TIN,

- the entity type (such as individual, partnership, LLC, corporation, etc.),

- the signature and date of the person certifying the information provided are accurate.

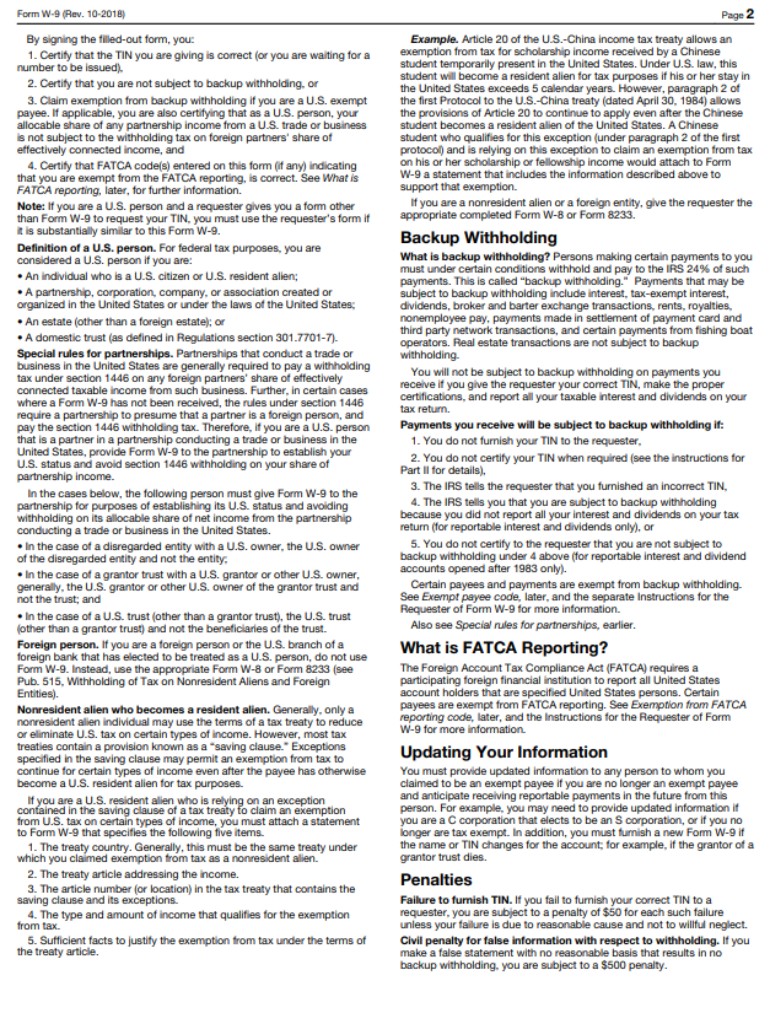

It's important to note that failure to provide a TIN, providing an incorrect TIN, not signing the form, not choosing the correct entity type, or not keeping a copy of the form for records may lead to penalties imposed by the IRS.

Ways to file the form

One of the advantages of the W-9 form is that it is available for electronic filing. The Internal Revenue Service (IRS) offers a fillable version of the form on their website, which can be completed and filed electronically. This method of filing offers several advantages over traditional paper filing. Electronic filing is more efficient and convenient as it eliminates the need to print out a paper form, fill it out by hand and mail it in. Additionally, electronic filing eliminates the risk of errors caused by handwriting or miscommunication, and it's more secure as the information is transmitted directly to the IRS reducing the risk of lost or stolen forms.

However, it's important to keep in mind that the process for filling out and filing a W-9 form may vary slightly between different states in the United States, as each state may have its own specific tax laws and regulations that need to be taken into account. For example, some states may have different deadlines for submitting the form, may require that the form be filed with a state tax agency in addition to the IRS or may have different requirements for what information needs to be included on the form.

It's always good to check with the state tax agency or consult a tax professional to ensure compliance with state tax laws and regulations and to avoid errors or penalties. Additionally, it's important to make sure you have the most recent version of the form and keep a copy for your records. It is also important to double check the form before submitting it to ensure that all the information is correct and accurate to avoid errors or delays in the tax reporting process.